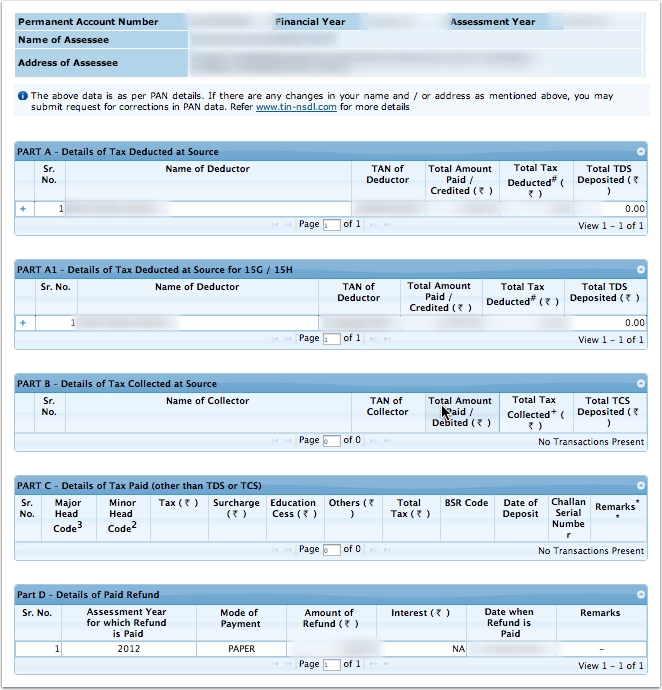

The Tax Credit Statement (Form 26AS) are generated wherein valid PAN has been reported in the TDS statements.It is a form issued under Rule 31AB. Also called as Details of AIR((Annual Information Return) transactions,Part E of Form 26AS.

Details of the High value Transactions in respect of shares, mutual fund etc.Details of paid refund received during the financial year, Part D of Form 26AS.deposited by the taxpayers (PAN holders), Part C of Form 26AS Advance tax/self assessment tax/regular assessment tax, etc.Details of tax collected on behalf of the taxpayer by collectors. Part B of Form 26AS.Details of tax deducted on behalf of the taxpayer by deductors ,Part A & A1 of Form 26AS.Income Tax Department facilitates a PAN holder to view its Tax Credit Statement (Form 26AS) online.

Basics of Tax Deducted at Source or TDS covers TDS in detail. Income Tax Department’s initiative to receive information and maintain records of tax paid through banks through online upload of challan details is termed as OLTAS (Online Tax Accounting System). The person/organization deducting the tax is called as Deductor while the person from whom the tax is deducted is called Deductee. Deductor is also termed as Employer and Deductee is termed as an Employee in cases where the payments are Salaries.Every person responsible for making payment of nature covered by TDS provisions of Income Tax Act shall be responsible to deduct tax. Our article Information about TDS deducted is made available to the PAN Holder via Form 26AS. This withheld amount can be adjusted against tax due. TDS or Tax Deducted at Source, is one of the modes of collection of taxes, by which a certain percentage is deducted at the time of payments of various kind such as salary, commission, rent, interest on dividends etc and deducted amount is remitted to the Government account.

0 kommentar(er)

0 kommentar(er)